To keep this guide simple – we've written this article specifically to cater to Active, Singapore Private Limited companies only.

In cases where you need to change your Financial Year End (FYE) of your company, how do you do it, and what is the procedure?

Most companies shouldn’t need to change their FYE after their first FYE has ended. As such, changing of FYE is usually most applicable for newly incorporated private companies who may have erroneously stated their FYE.

Whilst you can change your financial year end, you should not do so to work around the respective annual compliance deadlines of a company.

How To Change your Financial Year End (FYE)

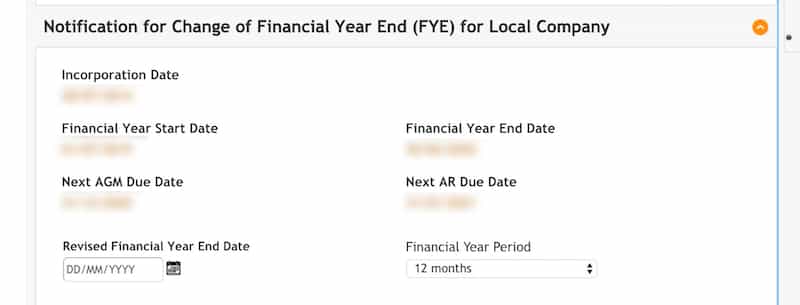

Aside from your own internal change within the company – you would need to file the change of FYE to ACRA. Fortunately, the filing itself is relatively straight forward, and there is no filing fee imposed from ACRA.

Time Needed: 15 minutes

Requirement

Follow these steps

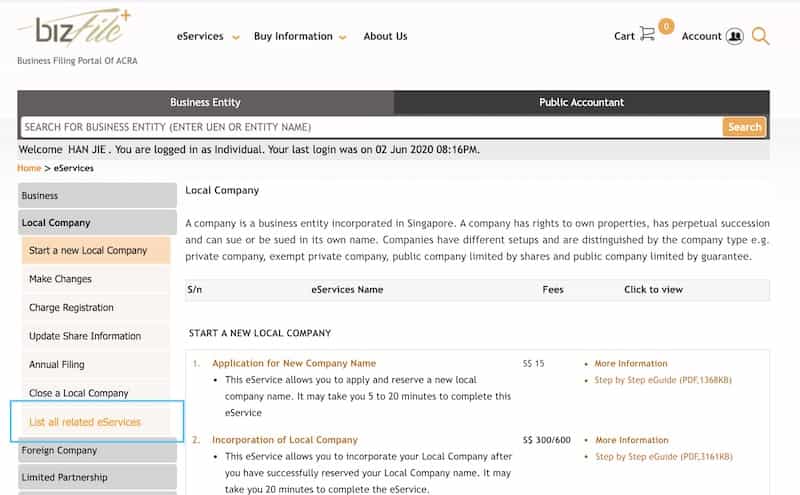

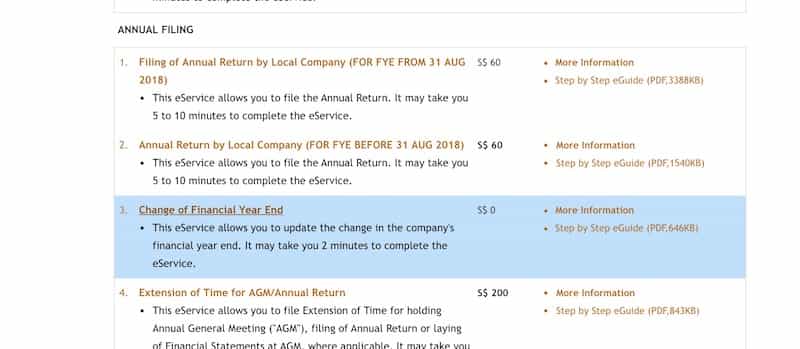

Step 4

Scroll down until you see ‘Change of Financial Year End’. You would have to scroll down at least half of the page as the option is quite far below. After which, enter your company’s UEN.

Considerations and Criteria Prior to Changing of FYE

Require ACRA’s approval prior to change

• If your change in FYE result in a financial year of more than 18 months or,

• The company had previously changed its FYE within the previous 5 years.

Change of FYE eligibility

• Can only change the current, or direct previous FYE.

• Cannot change FYE to get around the filing deadlines from the orignal FYE.

Preparation of Director’s Resolution

You should prepare the necessary resolution, and have your director(s) sign to approval the change of FYE prior to notifying ACRA. Usually, a Company Secretary would be able to assist with the drafting of the resolution.